- Shanghai Zhongshen International Trade Co., Ltd. - Two decades of trade agency expertise.

- Service Hotline: 139 1787 2118

How to classify the customs declaration of exported mechanical and electrical commodity parts? This question seems simple, but in fact it involves knowledge in many fields such as international trade, customs regulations, and mechanical and electrical technology. In todays globalization, correctly classifying mechanical and electrical commodity parts is crucial to ensuring the smooth progress of international trade. Below, we will discuss this question in detail from three aspects.

I. What are the parts of mechanical and electrical commodities

First, we need to clearly define what constitutes mechanical and electrical product parts. In international trade, particularly under the Harmonized System (HS), the concept of parts has specific definitions. The HS is an internationally standardized system for classifying and coding goods, providing clear descriptions of mechanical and electrical parts. Typically, any component of machinery or equipment can be considered a part, but these parts usually lack independent functionality and require assembly into complete machines to function. During classification, we must distinguish between parts and complete machines because complete machines have independent functions while parts generally do not.

II. Classification principles of parts

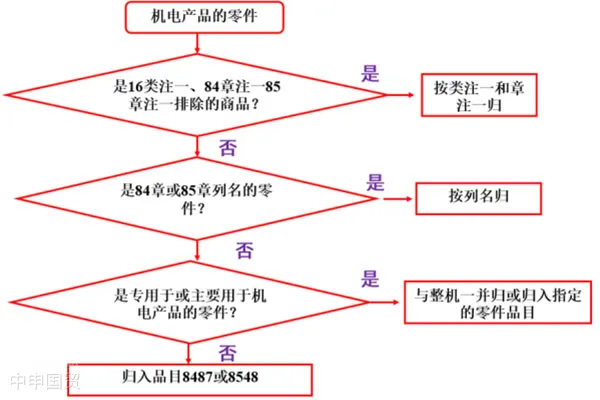

After understanding what are the parts of mechanical and electrical commodities, lets take a look at how to classify them. The classification principles are the basic rules for guiding the customs declaration of exported mechanical and electrical commodity parts. According to the notes of Section XVI of the Harmonized System, we can summarize the classification principles as follows:

Principle of specific listing:If a part has a specific listing in Chapter 84 or Chapter 85, it should be classified according to the listing.

Principle of special purpose:Parts that are specially or mainly used for a certain machine or multiple machines of the same heading should be classified together with the machine or into a specific heading.

Principle of universality:General parts that do not have special purpose are classified into general headings, such as Heading 84.87, 85.48 or 90.33.

In actual operation, we also need to consider the provisions of the exclusive clauses, that is, the special provisions in the section notes and chapter notes. These provisions may affect the classification of parts.

III. Analysis of typical cases

To better understand these principles, lets look at some typical cases:

Plastic transmission belt for coating and developing machine:According to the exclusive clause in Note 1 of Section XVI, this kind of commodity should be classified into Chapter 39.

Steel gasoline filter for automobiles:Since this commodity has a specific listing in Chapter 84 (machines and apparatus for filtering or purifying liquids), it should be classified into Heading 8421.

Plastic frame for mobile phones:As a component of mobile phones, according to its shape and special purpose, it should be classified into Heading 8517.7030.

Oil seal ring:Since this is a non - special part that can be used in multiple machines or devices, it should be classified into Heading 8487 (parts of non - electrical machines not specified or included elsewhere).

Through these cases, we can see that correctly classifying mechanical and electrical commodity parts is a job that requires careful consideration and professional knowledge. Only by deeply understanding the specific characteristics and uses of the commodity and combining the provisions of the Harmonized System can an accurate classification decision be made.

Related Recommendations

© 2025. All Rights Reserved.Shanghai ICP No. 2023007705-2 PSB Record: Shanghai No.31011502009912

PSB Record: Shanghai No.31011502009912